Next chapter of NCC Group's strategy with investment for enhanced growth; robust H1 with market headwinds impacting current trading

NCC Group plc (LSE: NCC, "NCC Group" or "the Group"), a leading independent provider of global cyber security and resilience services, reports its interim results for the 6 months to 30 November 2022 ("the half year", "HY", "H1 2023", "the period").

Strategic highlights

- The next chapter of NCC Group's strategy is based on four pillars underpinned by Insight, Intelligence and Innovation across all our organisation:

- Our clients - focusing on the fastest growing sectors - specifically those which are highly-regulated and most exposed to cyber risk, including financial services, Technology, Media and Telecoms (TMT), Government and public sector, infrastructure and industrials companies

- Our capabilities - broader service portfolio addressing the full cyber security lifecycle, including:

- continuing to invest in our core technical assurance capabilities, such as continuous, always on cyber threat detection and penetration testing

- maintaining high quality of Incident Response services to help clients at their critical moments

- further development of our global managed services offering, increasing Annual Recurring Revenues (ARR)

- building an additional Consulting & Implementation Services proposition to help C-suite confidently meet increasing cyber security requirements

- Global delivery - transitioning from an international to a fully global business, building a global delivery organisation with new leadership tasked with developing the best skills through flexible resourcing, including offshore delivery and operations centre, with implementation in FY24

- Differentiated brands - launching distinct and relevant brands in FY24, Cyber Security & Software Resilience, growing market profile and visibility with C-suite and target buyers

In addition, we will continue with:

- Ongoing strategic review of our Software Resilience division and other core and non-core assets, as evidenced by our recent disposal of our legacy DDI Assurance business in December 2022 for £5.8m (of which £3.8m is contingent consideration)

- Rationalisation of property estate to ensure the business has the appropriate operational footprint over time

Strategic medium-term revenue growth targets will be:

- Mid-teens revenue growth in Cyber Security over the medium term following phased implementation of the strategic initiatives over FY23-FY24

- Sustainable single digit revenue growth in Software Resilience

- The implementation of the Group's strategic initiatives is expected to require additional investment in FY23 of c.£5m. The strategic initiatives are expected to give rise to underlying net returns on investments from FY24 onwards

- This investment will be complemented by acquisitions in new markets, products and capabilities where it makes strategic and financial sense. A new four-year enlarged £162.5m multi-currency revolving credit facility signed in December 2022, enables this investment

Financial highlights

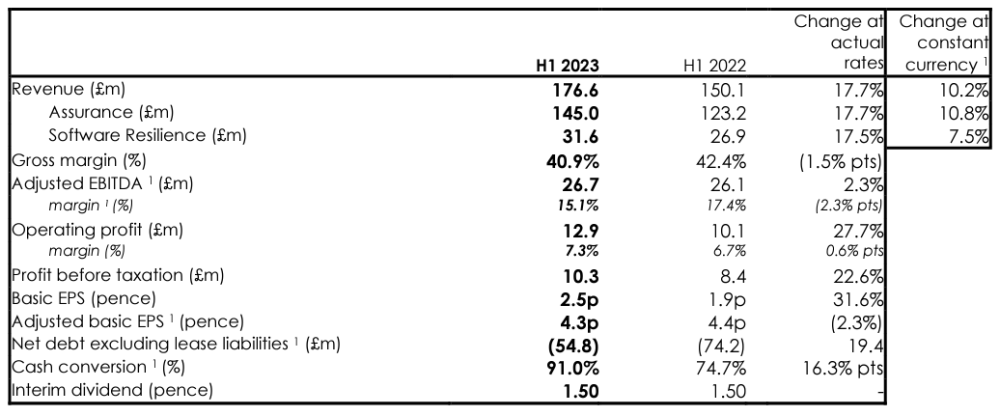

- Group revenue grew +10.2% at constant currency 1 (+17.7% actual rates), driven by North America and UK & APAC Assurance

- Group gross margin (%) decreased -1.5% pts due to a decline in Assurance of -2.1% pts due to lower utilisation and the reinstatement of NCC Conferences that gave rise to a direct and indirect cost

- Group operating profit and profit before taxation increased by +27.7% and +22.6% respectively

- The Group remains prudently leveraged at 1.0x, with net debt excluding lease liabilities of £54.8m following cash conversion of 91.0% (H1 2022: 74.7%)

Divisional highlights

Assurance

- Robust revenue growth of +10.8% at constant currency 1 (+17.7% actual rates), building on H2 2022 revenue growth momentum in North America and UK & APAC

- North America grew at +16.1% constant currency 1 (+34.5% actual rates)

- UK and APAC grew +12.0% constant currency 1 (+12.8% actual rates)

- Europe declined -2.8% constant currency 1 (-1.6% actual rates)

- Q1 2023 and Q2 2023 Assurance revenue increased by +5.4% and +15.5% at constant currency 1 respectively driven by North America and UK & APAC

Software Resilience

- Revenue increased +7.5% at constant currency 1 (+17.5% actual rates) before considering the prior period fair value adjustment of £2.7m, giving rise to revenue decline of -1.6% at constant currency 1 (+6.8% actual rates)

- Reorganisation of North American sales team led to a decline in Q1 2023 of -4.5% at constant currency 1, however Q2 2023 increased by +1.2% against the same comparator period (after considering the prior period fair value adjustment of £2.7m)

- IPM sales team now integrated into one North American team, new Managing Director and Finance Director onboarded to drive operational review and contribution to operating profit

- As previously announced, full contribution of annualised £5m cost saving from operational review to come through in FY24 following phased system integration improvements, with net c.£2m identified and being delivered in FY23

Outlook and interim dividend

Current trading

- Since the beginning of H2 2023 we have experienced a lengthening of the sales cycle, which is leading to delays in buying decisions, work commencement and therefore revenue recognition, particularly in North America and the UK

- Given the customer behaviour we are experiencing, 2023 Group revenues are expected to increase YoY by only single-digits (at constant currency 1) and still expecting to grow in H2 2023:

- Assurance revenue increasing YoY by high single-digits

- Software Resilience revenue (allowing for the prior period revenue fair value adjustment) declining YoY by c.1%

- As a result of the current market conditions, we are experiencing a reduction in our utilisation rates and attrition. We are therefore accelerating the implementation of our strategy and reshaping the business, with a proposed reduction in headcount in the near term

- Due to the macro-economic backdrop, and the savings arising from the actions to reshape the business, we expect FY23 Adjusted operating profit to be around £52m, before the investment we are making this year to implement the next chapter of our strategy

Strategic actions

- The Board remains confident in the medium-term prospects for the cyber market and these strategic actions will position the business to capitalise when the market improves

- Accordingly, the Board remains committed to implementing the next chapter of our strategy to enhance future growth through:

- Reshaping our global delivery and operational model, with a proposed c.7% reduction of our global headcount announced today, mostly in the UK and North America. This gives rise to a material one-off implementation cost (c.£4m) in H2 FY23 that is expected to be treated as an individual significant item

- Strategic investments of c.£5m in H2 FY23 to implement the 4 strategic growth pillars including enhancing our global delivery model by implementing an offshore delivery and operations centre in FY24. The strategic initiatives will give rise to underlying net returns on investments from FY24 onwards

- As result, we expect FY23 Adjusted operating profit to be around £47m (after the impact of FY23 strategic investments)

- We expect this investment to deliver our strategy will result in low to mid-teens Cyber Security revenue growth and an improvement in gross margins in FY24 due to the impact of increased utilisation and the new offshoring capability. Our expectations for Adjusted operating profit in FY24 are therefore unchanged

- In the medium term we believe our Cyber Security business can achieve mid-teens revenue growth and mid-teens Adjusted operating profit margins

Dividend

- Unchanged interim dividend of 1.50p (H1 2022: 1.50p) per ordinary share declared, as the Board prioritises investment in the new strategy

Mike Maddison, Chief Executive Officer, commented:

"The Group has delivered solid, double-digit growth in the first half of the year, building on our technical expertise and track record working with the world's leading brands and Government organisations. Despite the very evident global economic headwinds we are confident that the next chapter of our strategy will deliver a business positioned to fully capitalise on increasingly complex cyber challenges, and one that will be resilient in dynamic markets.

Our strategy, powered by a focus and investment in insights, intelligence and innovation across the organisation, will deliver enhanced growth in the medium term with a client-centric go-to-market model, market-leading capabilities & broader end-to-end offerings, efficiencies through global delivery and differentiated brands.

I look forward to working with my leadership team to deliver enhanced growth and drive greater market visibility of NCC Group in Boardrooms and Governments globally, to deliver on our purpose of creating a more secure digital future."

Analyst presentation briefing and Q & A session

A briefing for analysts will be held today at 9am at the offices of H/Advisers Maitland, 3 Pancras Square, London N1C 4AG. The briefing can be accessed via the following: https://www.investis-live.com/...

To read the RNS in full, please click here

Enquiries

NCC Group (www.nccgroupplc.com)

+44 (0)161 209 5432

Mike Maddison, CEO/ Tim Kowalski, CFO

H/Advisors Maitland

+44 (0)20 7379 5151

Sam Cartwright

Contact

NCC Group Press Office

All media enquires relating to NCC Group plc.